THE RESIDENTIAL GOLF COURSE BOOM OF THE 80’s AND 90’S

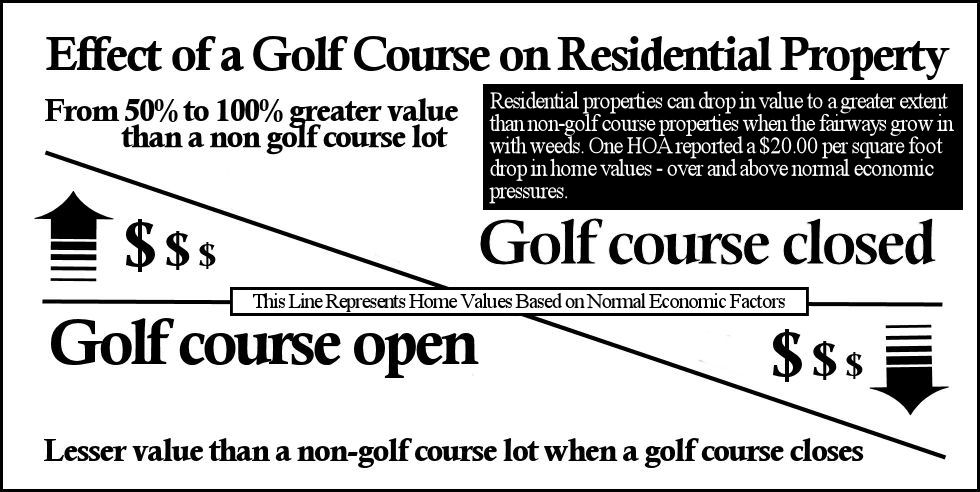

In just about every state in the USA there are residential developments with a golf course as the neighborhood centerpiece. They grew mainly during a period from around the early 1980’s through the 1990’s. It was evident then that a golf course as part of a residential development added value to property because of the desirability of a living against a manicured green space. Residential lots along a golf course were valued from 50% to 100% more than non-golf course lots – even if the resident didn’t play golf. Feasibility studies during those years indicated an average of one resident in four would actually play the golf course they live on. Wrong! The National Golf Foundation has always indicated it takes a nearby population of 25,000 people, or 2,500 golf players to support an 18-hole golf course. Therefore, every golf course created with fewer than 10,000 residences (2.5 persons per) was doomed to failure.

FAST FORWARD TO 2020 - It's an Epidemic!

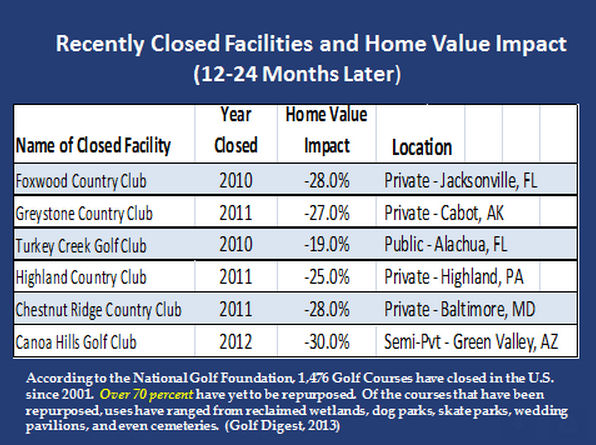

Many residential golf courses created between the 80’s and 2000’s are undergoing a severe financial crisis and hundreds, maybe thousands are threatened to close. Many of these golf courses need updated irrigation systems, and endless deferred problems due to normal wear and tear over the years. The premium the resident paid to have a golf course in the back yard can become a negative, because when a golf course closes it can cause a serious drop in property values. The following outlines an actual living example (I know, because I was there):

(Read this article by Michelle F Tanzer, Esq. "What's an HOA Do When the Golf Club is Failing?"

History: I was the last successful manager at a truly great Florida golf course known as The Ravines Resort in Middleburg, Florida on the south side of Jacksonville. I’m sure many of you (golfers) know of The Ravines, because it was a top-20 rated golf course among Florida’s 1,100, had a four-star Golf Digest rating and strong national rating. The Ravines is part of an upscale residential development.

After I left Ravines in 2003 subsequent management was not so lucky. The business failed and the property went back to the bank. The entire golf course became overcome with weeds and reached a point where recovery to original playing conditions became untenable (estimated as high as $3 million). The beautiful Ravines golf course today is an unsightly chest-high weed patch. However, the economic results really tell the story.

I learned recently that another nearby golf course, part of an 850 residential development, was also about to close. When the golf course owners appealed to the home owners association (HOA) for support, the response was, more or less, “We don’t care, because most of us don’t play golf.” They were not aware of the facts.

It took a meeting with the residents from the abandoned Ravines Golf Course to change their minds. In fact, the HOA at the ready-to-fail golf course voted almost unanimously to pay monthly social dues sufficient to provide enough new cash flow to the golf course to avoid its closing. What did they learn from the Ravines home owners?

At an auditorium style meeting a contingent of the Ravines home owners was invited to speak to the owners of the course that was on the brink. The Ravines group illustrated one dramatic fact: Property values around the Ravines Golf Course dropped a minimum of $20.00 per square foot when the golf course grew over with weeds.

A 4,000 square foot home dropped $80,000 in value as soon as the failure of the golf course became apparent.

A 6,000 square foot home dropped $120,000 as soon as the failure of the golf course became apparent.

When the facts were clear as to how their pocketbooks were affected by the closing of the golf course, the vote in favor was easy!

The Ravines people also told them their Ravines homes were virtually impossible to sell. Realtors were told to turn around and leave by their prospects who wouldn’t even look at a home with a failed golf course in their back yard.

I’m dealing with several golf course communities with a failing golf course. Here’s one example:

A residential community of 2,500 residences in a mix of single family and multi-family homes

- A 36-hole golf course that once was a going concern, but now dilapidated and ready to be abandoned

- The residents (the HOA) are unwilling to commit to any situation that might cost them money to rejuvenate and sustain the golf course.

- Their argument is that they *don’t play golf, so why should they care what happens to the golf course?

*Person’s who live in golf communities are not always golfers. In fact, the percentage of people living in golf course communities is probably not much more than the national average. Golf participation in the USA has been stated by the National Golf Foundation (NGF.org) at around 10%.

FIND OUT ABOUT A STRATEGY TO KEEP YOUR RESIDENTIAL GOLF COURSE ALIVE AND WELL

If your HOA is facing a similar dilemma with your neighborhood golf course write me: mike@golfmak.com.